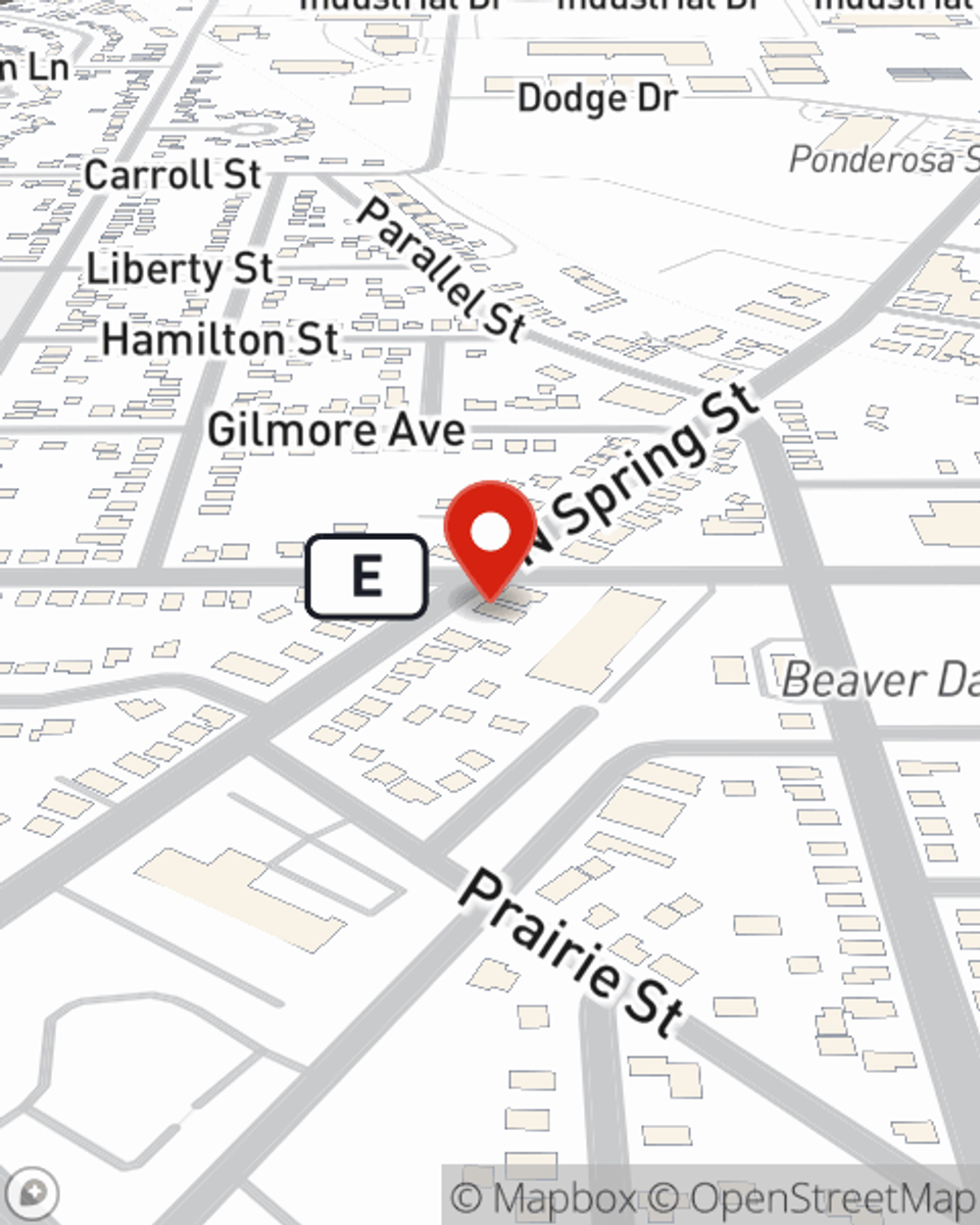

Life Insurance in and around Beaver Dam

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

- Wisconsin

- Beaver Dam

- Waupun

- Fox Lake

- Juneau

- Lowell

- Reeseville

- Randolph

- Cambria

- Clyman

- Watertown

- Iron Ridge

- Burnett

- Hustisford

- Markesan

- Waterloo

- Columbus

- Dodge County

- Columbia County

- Green Lake County

- Fond Du Lac County

- Washington County

- Jefferson County

- Dane County

State Farm Offers Life Insurance Options, Too

The normal cost of funerals in America is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the ones you leave behind to come up with that much money as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help your family pay for burial costs and not fall into debt.

Life goes on. State Farm can help cover it

What are you waiting for?

Put Those Worries To Rest

Some of your options with State Farm include coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Gina Oemig's wonderful customer service is what makes Gina Oemig a great asset in helping you pick the right policy.

Simply call or email State Farm agent Gina Oemig's office today to experience how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Gina at (920) 885-9115 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.